Super Micro Computer, Inc. (NASDAQ: SMCI), a leader in high-performance servers and AI infrastructure, has been one of the standout tech stocks of recent years. However, despite an impressive recovery throughout 2024, SMCI is currently facing a short-term decline. The stock dropped by 3.46% in the latest trading session, sparking concern among traders. Still, long-term investors are keeping an eye on the bigger picture—Super Micro’s strategic positioning in the booming AI industry.

Latest Trading Activity

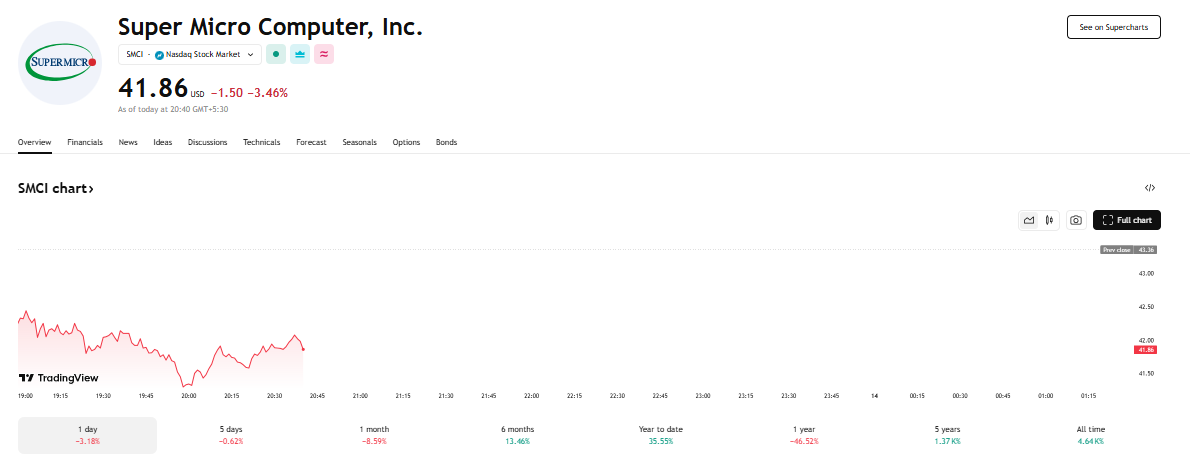

On the most recent trading day, Super Micro’s stock fell by $1.50, settling at $41.86. This represented a decline of 3.46%, extending a week of mild bearish activity. The drop reflects short-term volatility, which is not uncommon for growth stocks in emerging tech sectors.

Recent Performance Overview

-

1-Day Performance: -3.18%

-

1-Week Performance: -0.62%

-

1-Month Performance: -8.59%

While these figures show short-term weakness, the overall momentum for 2024 remains largely positive.

Year-to-Date Growth Remains Strong

Despite the recent drop, SMCI’s Year-to-Date (YTD) performance shows a +35.55% gain. This surge highlights investor confidence in the company’s prospects, especially amid rising demand for AI servers and edge computing solutions.

Long-Term Track Record

Super Micro has demonstrated an outstanding track record for long-term investors:

-

Five-Year Return: +1,370%

-

All-Time Return: +4,640%

These returns showcase the company’s ability to capitalize on major industry shifts, particularly around cloud computing, enterprise data centers, and AI hardware.

Read More: D-Wave QBTS Stock

Short-Term Concerns for Traders

The recent pullback could stem from a variety of factors including:

-

Overbought technical conditions after a sharp YTD rally

-

Market rotation out of growth stocks

-

Concerns around earnings forecasts or macroeconomic uncertainty

-

Investor profit-taking following strong gains earlier in the year

Such pullbacks are often healthy for long-term trends, providing opportunities for new buyers.

Super Micro’s Role in the AI Ecosystem

SMCI plays a crucial role in the AI value chain. It provides high-performance server platforms that power workloads for artificial intelligence, deep learning, and hyperscale data centers. As tech giants and startups race to build more intelligent systems, Super Micro’s products are increasingly in demand.

Its collaborations with NVIDIA, Intel, and AMD further solidify its role in the AI infrastructure landscape.

Comparison with Tech Peers

While many AI-related stocks have shown promising returns, few have delivered the same long-term ROI as Super Micro. Compared to companies like Dell or HP Enterprise, SMCI’s focus on high-efficiency, AI-optimized servers gives it a clear niche advantage.

Investor Sentiment: Mixed but Optimistic

Investor sentiment around SMCI remains cautiously optimistic. The recent dip is being interpreted by many analysts as a technical correction rather than a fundamental breakdown. Long-term investors are eyeing new entry points, while traders are watching support levels closely.

Market Outlook and What’s Next

Looking forward, investors are awaiting key catalysts such as:

-

Upcoming earnings reports

-

New product releases or AI partnerships

-

Updates on global data center demand

-

Macroeconomic indicators influencing tech stocks

If positive, these factors could reignite bullish momentum in SMCI shares.

Should You Buy the Dip?

This depends on your risk tolerance and investment horizon.

-

For Long-Term Investors: SMCI’s strong fundamentals and AI exposure make it a compelling play.

-

For Short-Term Traders: Wait for clear reversal signals or technical confirmations before entering.

-

For value seekers: Consider analyzing the stock’s P/E ratio, debt levels, and projected earnings growth.

FAQ About Super Micro (SMCI) Stock

What is the current stock price of Super Micro Computer (SMCI)?

As of the latest update, SMCI is trading at $41.86.

Why did SMCI stock drop today?

It declined by 3.46%, likely due to short-term selling pressure, technical pullback, or broader tech market weakness.

What is SMCI’s year-to-Date (YTD) return in 2024?

The stock is up 35.55% year-to-date, showing strong performance in the AI boom.

What is the one-month performance of SMCI?

Over the last month, SMCI has dropped 8.59%, indicating a short-term correction.

What is SMCI’s performance over the past year?

The stock is down 46.52% over the last year, reflecting a major correction in late 2023.

How has SMCI performed in the last 5 years?

SMCI has delivered over 1,370% gains in five years, one of the best returns in the tech sector.

Is SMCI a good investment for long-term growth?

Given its AI infrastructure focus and historical returns, it can be a strong pick for growth-oriented investors—though volatility remains a concern.

What was the previous closing price for SMCI?

The previous session closed at $43.36.

What is the all-time performance of SMCI stock?

SMCI has returned over 4,640% since inception.

Which exchange is SMCI listed on?

SMCI trades on the Nasdaq Stock Market.

Is SMCI stock affected by the AI market?

Yes, significantly. Its business is directly tied to demand for AI servers and data center hardware.

Is SMCI stock priced in USD?

Yes, all quoted prices are in United States Dollars (USD).

Conclusion

Super Micro (SMCI) continues to be a fascinating case of a high-growth tech company navigating volatility in a fast-evolving market. While recent price drops may cause concern for short-term traders, the long-term story remains promising, fueled by innovation, strong fundamentals, and the ever-growing demand for AI-powered infrastructure.

Investors should keep a close eye on market developments, financial statements, and broader tech sentiment before making any moves. As always, diversification and risk management are key when investing in fast-moving tech stocks.

Disclaimer: This article is only for information and learning purposes. It is based on one analysis and should not be taken as financial or investment advice. Investing in stocks involves risk, so always do your own research and talk to a financial advisor before making any decisions.