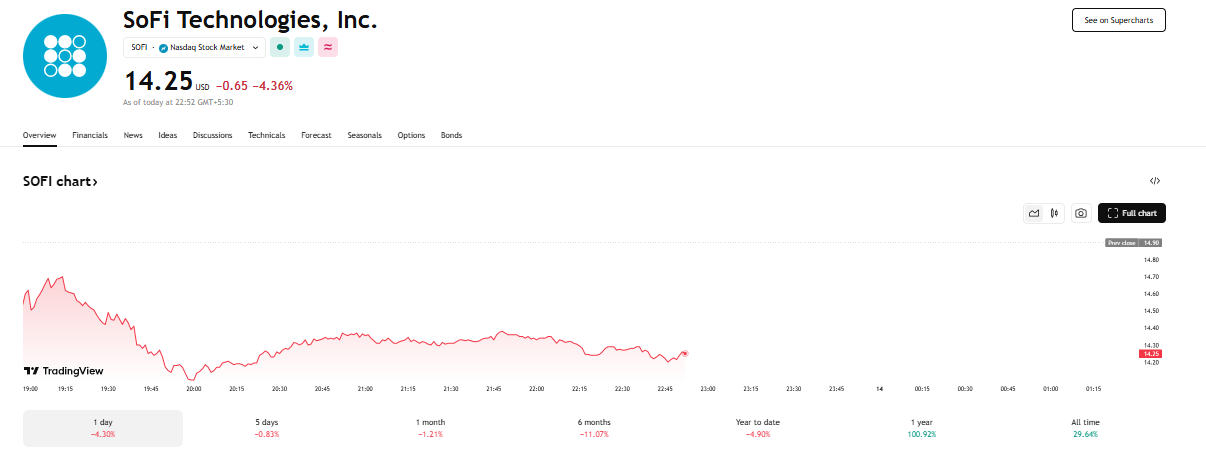

SoFi Technologies, Inc. (NASDAQ: SOFI), a leading digital finance platform, has been on an impressive run over the past year, with its stock price more than doubling. But in a recent trading session, SOFI shares dipped by over 4%, marking a potential cooling-off phase in what has been a strong rally. Investors are now weighing whether this pullback is simply a healthy correction or a sign of deeper volatility to come.

A Look at SoFi’s Recent Stock Performance

SoFi stock has experienced a sharp rise over the last 12 months, benefiting from a growing customer base, expansion into banking services, and rising investor confidence in fintech innovation. However, in the latest trading session, SOFI shares dropped more than 4%, halting the bullish momentum temporarily.

This decline, though modest in the larger context, raises questions about market sentiment and potential profit-taking after such an extended upward move.

Yearlong Rally: What Drove SOFI’s Growth?

Several key factors contributed to SoFi’s strong stock performance in the last year:

-

Bank Charter Benefits: SoFi’s acquisition of a national bank charter enabled it to expand lending operations, reduce costs of capital, and enhance revenue generation.

-

User Growth: The company reported consistently rising active members, with millions of new users joining the platform for services like investing, student loan refinancing, and savings.

-

Product Diversification: Beyond lending, SoFi now offers investing tools, credit card services, and financial education, broadening its appeal.

-

AI & Tech Integration: Adoption of AI in underwriting and customer support has improved efficiency and user experience.

These tailwinds turned SoFi from a niche fintech player into a more holistic financial ecosystem, which investors have rewarded with higher valuation multiples.

Understanding the Recent Pullback

The current slide in SOFI stock appears to be driven by a few converging factors:

-

Profit-Taking: After a 100%+ gain in 12 months, some investors are likely cashing out, locking in profits.

-

Market Volatility: Broader tech and fintech sectors are facing increased volatility due to rate hike fears, inflation concerns, and earnings season uncertainty.

-

Valuation Concerns: Some analysts argue that SoFi’s stock price may have outpaced fundamentals, making it susceptible to correction.

-

Short-Term Headwinds: Slower student loan refinancing demand and regulatory noise may be temporarily weighing on sentiment.

Analyst Sentiment and Wall Street Views

Market analysts remain mixed on SoFi. Some see the dip as a buying opportunity, citing strong fundamentals and long-term growth, while others urge caution due to valuation pressures.

-

Bullish Analysts: Highlight SoFi’s rapid user growth, monetization potential, and the benefits of vertical integration in finance.

-

Bearish Views: Focus on rising expenses, thin profit margins, and potential macroeconomic headwinds.

Overall, the consensus is that SoFi has long-term promise, but short-term volatility is likely to persist.

SoFi’s Business Model and Growth Strategy

SoFi’s strategy is centered around becoming a one-stop financial super-app. Key pillars include:

-

Lending: Offering personal loans, student loan refinancing, and home loans.

-

Banking: High-yield checking and savings, with FDIC-insured deposits.

-

Investing: Commission-free trading, crypto trading, and automated portfolio options.

-

Financial Education: Helping users improve credit scores, budget effectively, and build wealth.

This all-in-one approach is designed to boost lifetime customer value and reduce churn.

Customer Growth and Financials

SoFi’s user growth remains a standout metric. The company recently surpassed 7 million members, up significantly year-over-year. Its financials have also shown improvement:

-

Revenue Growth: Net revenue has seen double-digit increases.

-

Adjusted EBITDA: Moving toward profitability, with narrower losses and better operating leverage.

-

Deposit Growth: Users are keeping more funds with SoFi, boosting trust in its banking services.

However, profitability remains a target rather than a reality. That gap is something analysts and investors are watching closely.

Risks to Watch

While SoFi has momentum, several risks remain:

-

Macroeconomic Pressure: Rising interest rates could impact loan demand.

-

Regulatory Changes: Fintech regulations continue to evolve, which could affect product offerings.

-

Competitive Landscape: Traditional banks and newer startups are vying for the same audience.

-

Tech Reliability: As a digital-first company, platform outages or cybersecurity issues could hurt reputation.

Investors need to factor in these variables before making long-term bets.

SoFi in the Broader Fintech Revolution

SoFi is not just a stock—it represents the future of banking in a digital-first world. Its peer-to-peer lending roots have evolved into a full-stack, mobile-native financial platform that challenges legacy institutions. As Gen Z and millennials seek tech-forward solutions, companies like SoFi are poised to thrive—if they can deliver on their promises.

FAQ About SoFi (SOFI) Stock

Why did SoFi stock drop over 4% recently?

Likely due to profit-taking, broader market volatility, and temporary valuation concerns.

How much has SOFI stock gained in the last year?

SOFI stock has more than doubled (over 100% gain) in the past 12 months.

What does SoFi do?

SoFi offers banking, lending, investing, and financial planning through a single app.

Is SoFi profitable yet?

No, but it is approaching profitability with narrowing losses and rising adjusted EBITDA.

How many users does SoFi have?

As of the latest reports, SoFi has over 7 million members.

What is the biggest strength of SoFi?

Its all-in-one financial services model that simplifies banking and investing for users.

What are the risks with investing in SOFI?

Regulatory changes, macroeconomic pressures, and increasing competition.

Does SoFi have a bank charter?

Yes, it acquired a national bank charter which strengthens its ability to lend and accept deposits.

Can you trade crypto on SoFi?

Yes, SoFi offers cryptocurrency trading through its platform.

Is SoFi a long-term investment?

Many analysts believe so, given its strong brand, user growth, and tech focus—but risks remain.

What’s the analyst rating on SOFI?

Mixed; some rate it a “buy” for growth potential, others caution due to current valuation.

What sectors does SOFI compete in?

SoFi competes in fintech, digital banking, lending, investing, and personal finance education.

Conclusion: Is This a Buying Opportunity?

SoFi’s recent 4% dip should be viewed in context. After more than doubling in a year, some pullback is natural. Long-term investors may see this as a potential buying opportunity, especially if the company continues to show strong user growth and improves its path to profitability.

As with any high-growth stock, SOFI comes with risks—but also with the potential to reshape how modern consumers manage money.

Disclaimer: This article is only for information and learning purposes. It is based on one analysis and should not be taken as financial or investment advice. Investing in stocks involves risk, so always do your own research and talk to a financial advisor before making any decisions.