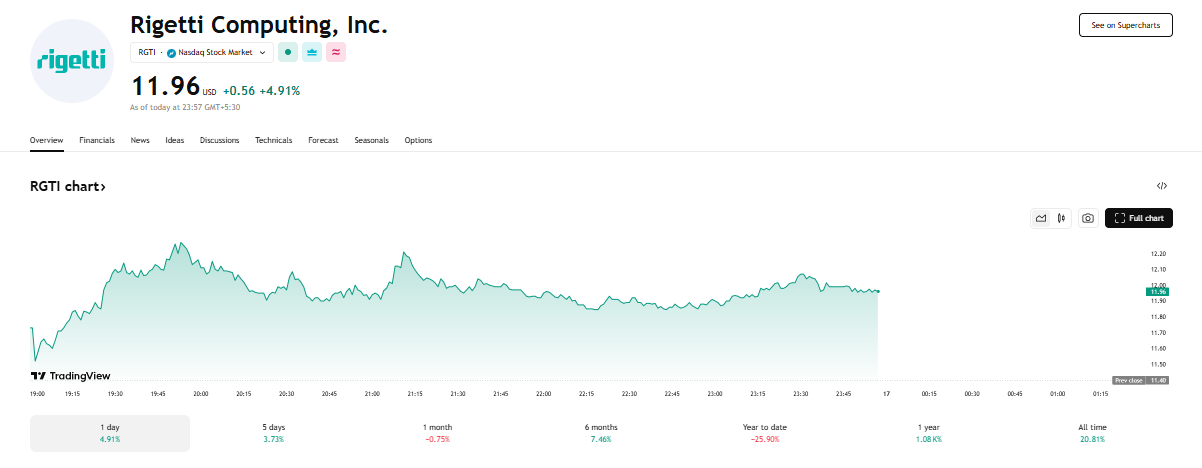

Rigetti Computing (NASDAQ: RGTI), a leading quantum computing company, has shocked Wall Street with a jaw-dropping 1,000%+ rally in 2025. On the latest trading day, shares climbed another 5%, adding fuel to an already historic surge. The dramatic price movement reflects both investor excitement and the broader momentum building around quantum technologies.

As Rigetti continues to grow and attract attention, both retail and institutional investors are asking: What’s fueling this rally—and can it last?

Company Overview: What Is Rigetti Computing?

Rigetti Computing is a pioneer in full-stack quantum computing. Unlike traditional tech firms, Rigetti builds both quantum processors and the software required to run quantum algorithms. Founded in 2013, the company has positioned itself as one of the few startups capable of delivering scalable, cloud-accessible quantum systems.

With headquarters in Berkeley, California, Rigetti aims to revolutionize industries ranging from cryptography and drug discovery to finance and AI.

What Sparked the 5% Daily Gain?

While the daily 5% gain may appear modest compared to the stock’s annual climb, it reflects ongoing bullish sentiment. Here are a few possible drivers behind the latest price move:

-

Positive mentions by analysts and influencers on social media platforms.

-

Continued optimism around quantum computing adoption.

-

Retail investor enthusiasm building on speculative momentum.

-

Hints at upcoming government or enterprise contracts.

The volume behind the move suggests strong buying pressure, not just random volatility.

A Closer Look at the 1,000% YTD Rally

A 1,000%+ gain in under six months is extraordinary. Several factors have contributed to this massive uptick:

-

Renewed Interest in Quantum Technology

The tech world has increasingly shifted focus to quantum computing as the next frontier. Companies like IBM, Google, and D-Wave are making strides—and Rigetti is being pulled upward with this momentum. -

Major Milestones in Hardware Development

Rigetti recently announced breakthroughs in quantum gate fidelity and qubit count, critical measures in quantum computing. These improvements signal that the company is making real, usable progress. -

Strategic Partnerships and Contracts

In 2025, Rigetti secured new government research contracts and commercial partnerships, validating its technology and opening new revenue channels. -

Speculative Investor Activity

As with many high-growth tech stocks, speculative momentum has amplified returns. Retail traders and momentum funds have piled into RGTI, creating a self-reinforcing upward cycle.

Market Sentiment: FOMO in Full Effect?

The current market sentiment surrounding Rigetti suggests a classic case of FOMO (Fear of Missing Out). As more headlines tout the company’s success, casual investors are jumping in, further driving demand. On platforms like Reddit’s WallStreetBets, Rigetti has become a hot topic.

That said, seasoned investors remain cautious. While quantum computing holds enormous promise, the road to profitability is long—and risks remain high.

Financial Performance and Earnings Outlook

Rigetti is still a pre-revenue or low-revenue company, burning capital to fund innovation. According to recent filings:

-

Annual revenue remains under $20 million.

-

Losses are narrowing but still significant.

-

The company holds enough cash to operate through 2026.

Earnings are not expected soon. Most of the valuation is based on future expectations, not current performance. This makes the stock highly sensitive to both good and bad news.

Industry Growth: Why Quantum Is Heating Up

The global quantum computing market is projected to grow from $1.2 billion in 2024 to over $10 billion by 2030, according to multiple research firms. Governments and corporations alike are investing in the tech due to its potential to solve problems that are impossible for classical computers.

Key growth drivers include:

-

National security and cybersecurity use cases

-

Drug development and medical simulations

-

Complex financial modeling

-

AI and machine learning acceleration

Rigetti’s positioning as a U.S.-based, vertically integrated quantum firm makes it a strong contender in this space.

Risks to Watch

Despite the hype, Rigetti is not without risks:

-

Execution Risk: Failing to meet development milestones could crash the stock.

-

Dilution Risk: The company may issue more shares to raise funds, diluting existing shareholders.

-

Competition: Google, IBM, and Amazon have significantly larger R&D budgets.

-

Market Volatility: The speculative nature of RGTI stock makes it prone to sharp corrections.

Investors should tread carefully and be prepared for potential downside volatility.

Analyst Opinions: Mixed but Upward-Revised

Wall Street analysts are beginning to pay attention to RGTI. While coverage is still limited, recent notes highlight:

-

“Aggressive growth trajectory with strong IP moat.”

-

“Highly speculative—valuation disconnected from fundamentals.”

-

“Quantum leadership in mid-tier enterprise solutions.”

Price targets now range from $3.50 to $12.00, with the current price trending toward the upper end.

What’s Next for Rigetti Stock?

The future of RGTI stock depends on several variables:

-

Upcoming technical and business updates

-

Broader tech sector sentiment

-

Government funding announcements

-

Possible acquisition rumors from larger tech firms

If the company continues to exceed expectations, another leg higher is possible. However, any negative news could lead to a steep correction.

Frequently Asked Questions (FAQ)

What does Rigetti Computing do?

Rigetti develops quantum computing hardware and software, providing cloud-based access to its quantum processors.

Why has RGTI stock gone up so much?

The stock has surged over 1,000% in 2025 due to investor excitement around quantum computing, positive technical progress, and speculative momentum.

Is Rigetti a profitable company?

No. The company is still pre-profit and relies on outside funding to continue operations and R&D.

What’s the long-term outlook for quantum computing?

Very strong—experts believe quantum will eventually transform industries like cybersecurity, pharmaceuticals, and finance.

Where is RGTI stock listed?

Rigetti Computing trades on the NASDAQ under the ticker symbol RGTI.

What are the key risks of investing in Rigetti?

Execution delays, intense competition, lack of profitability, and market overvaluation.

Does Rigetti have government contracts?

Yes. It has secured funding and collaborations with agencies such as DARPA and the Department of Energy.

How high can RGTI go?

Analyst targets vary widely. Future stock price depends heavily on performance and investor sentiment.

Who are Rigetti’s competitors?

IBM, Google, IonQ, and D-Wave are among the leading rivals in quantum computing.

Is this a good time to buy RGTI stock?

It depends on your risk tolerance. The stock has strong momentum but is highly speculative.

Conclusion

Rigetti Computing’s 1,000%+ rally in 2025 is one of the most eye-catching stories in tech investing this year. With real breakthroughs in quantum and rising demand for next-gen computing solutions, Rigetti is on a high-stakes journey. Whether it’s a moonshot or a bubble remains to be seen—but one thing is clear: all eyes are now on RGTI.