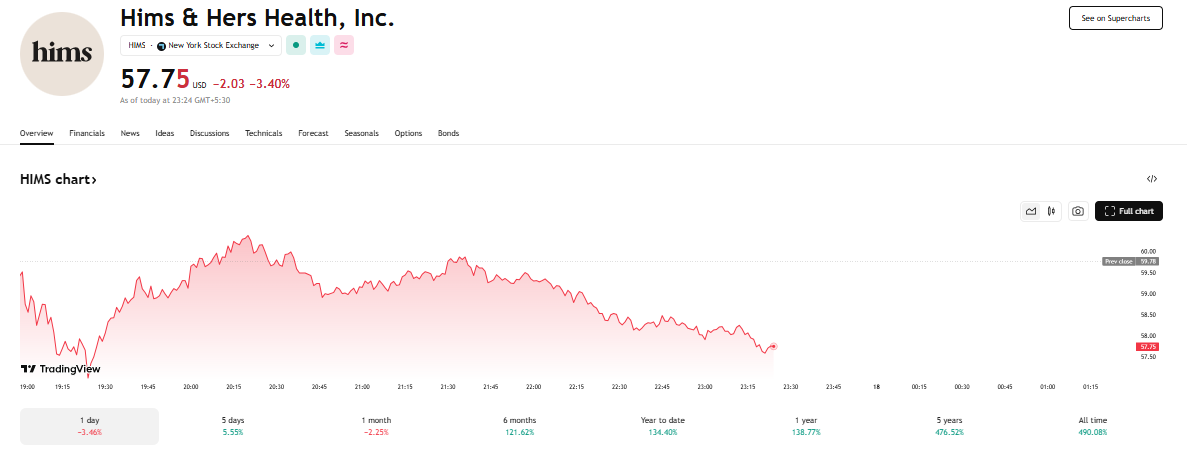

After delivering a powerful 134% rally in 2025, Hims & Hers Health, Inc. (NASDAQ:HIMS) stock has entered a cooling phase, sparking debate among investors: Is this a healthy consolidation or the start of a trend reversal? Let’s break down what’s happening, what’s driving the gains, and what’s next for this rapidly growing digital health company.

Company Overview: What Is Hims & Hers?

Hims & Hers Health, Inc. is a telehealth platform that provides access to medical and wellness products for a range of conditions — from mental health and hair loss to sexual health and skincare. With its sleek branding and direct-to-consumer approach, it has gained popularity among millennials and Gen Z.

The platform connects users with licensed healthcare professionals online and delivers treatment plans and products discreetly to their doorsteps.

2025 Performance Recap: 134% Rally

So far in 2025, HIMS stock has climbed 134%, marking it as one of the standout performers in the health-tech sector. This surge was fueled by:

-

Strong quarterly earnings beating analyst expectations

-

Surging revenue growth, especially from subscriptions

-

Expanded product offerings in mental health and weight loss

-

Positive analyst ratings and upward price target revisions

-

Growing market share in telehealth

The impressive rally reflects increasing investor confidence in the company’s business model and its long-term potential in the digital health space.

What’s Behind the Recent Pause?

Despite its year-to-date success, HIMS stock has paused in recent trading sessions. This is a common occurrence after such a rapid climb and is often seen as a natural market correction or consolidation.

Some of the contributing factors include:

-

Profit-taking by early investors

-

Broader tech market volatility

-

Short-term valuation concerns

-

Mixed reactions to industry regulation changes

Investors are now watching closely to see if the stock will stabilize and build a new base or slide further in a deeper correction.

Strong Revenue and User Growth

Hims & Hers has consistently reported strong revenue and customer growth. In its most recent earnings report, the company showed:

-

Revenue growth exceeding 45% year-over-year

-

Over 1.7 million active subscribers

-

An increase in recurring subscription revenue

-

Improved gross margins and lower acquisition costs

These key performance indicators suggest solid fundamentals behind the stock’s rally.

Expanding into Weight Loss & Mental Health

One major catalyst for the company in 2025 has been its expansion into weight loss treatments, such as GLP-1 medications (similar to Ozempic), and its growing investment in mental health services. These two markets represent multi-billion-dollar opportunities and fit well within the Hims & Hers ecosystem.

The company is also working to integrate AI-driven personalized care to improve customer experience and scalability.

Market Position: How Does HIMS Compare?

Hims & Hers operates in a competitive landscape with rivals such as:

-

Teladoc Health (TDOC)

-

Ro

-

Lemonaid Health

-

GoodRx (GDRX)

What sets HIMS apart is its brand-first strategy, combining medical care with consumer marketing in a way that resonates with younger generations. This allows for strong customer loyalty and high retention rates.

Risks and Considerations

Despite the promising growth, investors should keep in mind the potential risks:

-

Regulatory scrutiny on telehealth practices and prescription services

-

Increased competition driving up acquisition costs

-

Dependence on third-party pharmacies and fulfillment

-

Potential overvaluation after such a sharp rally

Risk-tolerant investors may find the stock attractive, but long-term success will depend on execution and scalability.

Analyst Outlook: Bullish but Cautious

Analyst sentiment around HIMS remains largely bullish, with many firms upgrading the stock following strong earnings. However, some analysts are cautious, citing valuation concerns and possible headwinds if user growth slows down.

Current price targets range from $12 to $18, depending on the firm’s outlook.

What’s Next for HIMS Stock?

Looking ahead, several things could determine the next move for HIMS:

-

Upcoming quarterly earnings results

-

Subscriber growth trends

-

Expansion into new health categories

-

Broader market sentiment in health tech

If the company continues to innovate and expand its offerings, HIMS could maintain its status as one of the most exciting growth stocks in digital health.

Frequently Asked Questions (FAQ)

What does Hims & Hers Health, Inc. do?

Hims & Hers is a telehealth company offering online medical consultations and wellness products for issues like mental health, hair loss, and skincare.

Why has HIMS stock surged in 2025?

The stock rallied due to strong earnings, subscriber growth, and expansions into weight loss and mental health services.

Is HIMS stock profitable?

As of now, the company is not yet profitable, but it is narrowing its losses and growing recurring revenue rapidly.

What are the main growth drivers for HIMS?

Key growth areas include telehealth subscriptions, mental health services, GLP-1 weight loss treatments, and personalized medicine.

Why did the stock pause recently?

The pause may be due to profit-taking, broader tech market volatility, and short-term valuation concerns.

What is the current market cap of Hims & Hers?

As of mid-2025, the company has a market capitalization of around $4–5 billion, depending on daily trading.

Who are HIMS’s main competitors?

Competitors include Teladoc Health, Ro, Lemonaid Health, and GoodRx.

Is HIMS stock a good long-term investment?

It has strong potential but also carries risks. It’s suited for growth investors who can tolerate short-term volatility.

Where is HIMS stock traded?

HIMS is listed on the New York Stock Exchange (NYSE) under the ticker HIMS.

Can I access Hims & Hers services outside the U.S.?

Currently, services are mostly limited to the United States, but the company may expand internationally in the future.

Conclusion

Hims & Hers (HIMS) has made a significant mark in 2025 with a 134% rally, powered by strong growth and strategic expansion. While the stock has paused, its long-term potential in digital health remains strong. As always, investors should monitor earnings, evaluate fundamentals, and consider risk tolerance before making a decision.